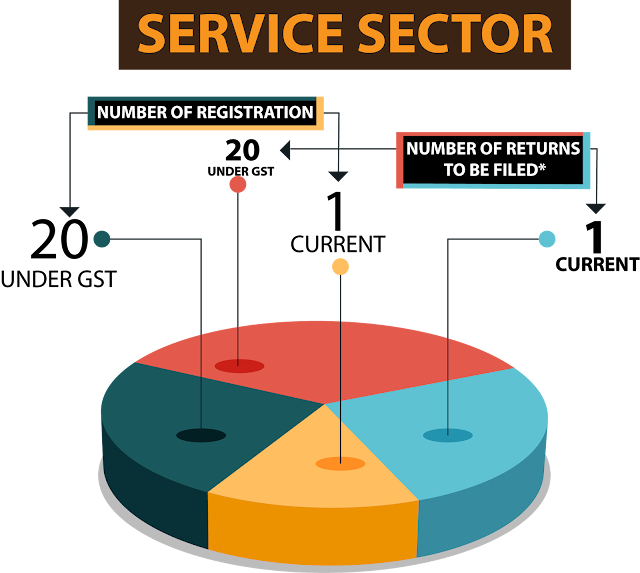

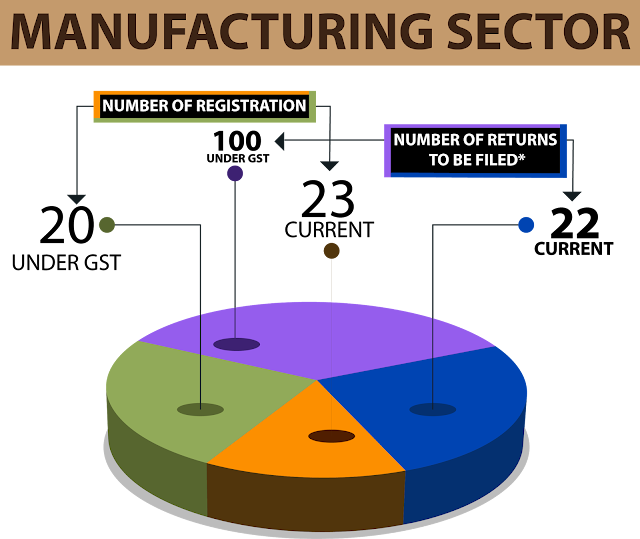

Quality of

the tax system in India would become better because of the coming of the GST.

This is because the burden of the tax system would get redistributed equitably

between the Top GST Consultant In India services and the manufacturing. A study for finding the impact of

the GST on the growth of the GDP and exports was conducted by the NCEAR on the

request of the finance commission.

The study

explored the impact of the GST on the growth via two methodologies-the direct

cost reduction methodology and the cost reduction on the inputs of the capital

methodology. The results revealed that the growth in the GDP could be about 2

to 2.5 %. The exports might get increased by about 10 to 14 %. This indeed is

an astonishing increase.

There seems

to be a belief that the growth in the GDP to be two would be the best option. A

single rate, Ind AS Implementation the GST would lead to low costs of compliance, eliminate disputes

of classifications and ensure approach’s uniformity amongst all the players.

The rates should also be sufficed to be able to address all the concerns of the

states associated with the revenue. In fact, the neutrality of the state revenue

would be imperative.

For the

success of the GST, all the states as well as the centre would require the implementation

of the GST in the same manner. Through this only, the national common market

could be made. The GST is the single major tax reform post 1991-92. India’s

fiscal system Tax Advisory Services In India would possess the cutting edge after the flawless GST and the new

direct code of the taxes. The profits get increased by 20 percent only by 2

percent reduction in the costs. This would lead to the investments. Industries

because of the low costs due to the disappearance of the cascading taxes would

invest more and enhance the growth rate.

For queries

associated with GST, GST Implementation, Roadmap to GST and GST Rates in India.

contact AKGVG and Associates and CAC India at. +91- 9811118031