It seems that the government is prepared to implement the

GST from the 1st April, 2017. Implementation of the GST would

require the transformation of the business. Introduction of the GST would Roadmap To GST Implementation require review as well as the change of the supply chain, tax positions, accounting,

business processes and enterprise resource planning (ERP) systems. The time for

the implementation of the changes is quite limited.

The introduction of the GST would bring an increase in the

tax compliance obligations.

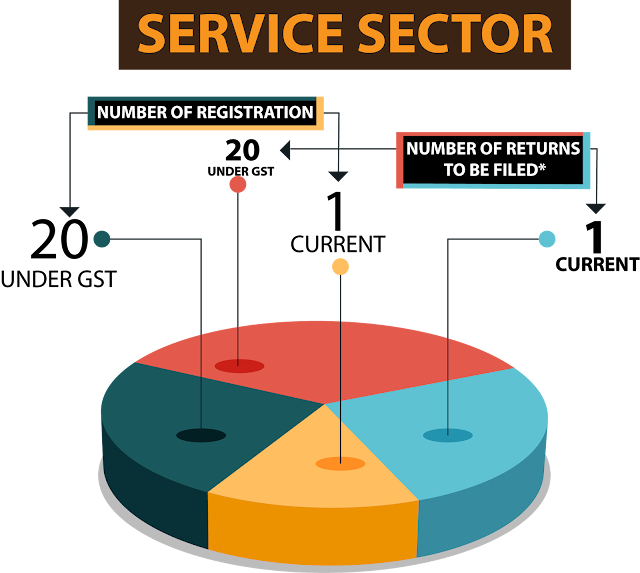

Today, a service provider having operations in twenty states

can get a single centralized service tax registration but under the GST a

separate registration would be required for every state. A service provider who

is filing about three service tax returns per year would have to file four to

five returns per state per month. This tentatively comes out to be 100 returns

per month.

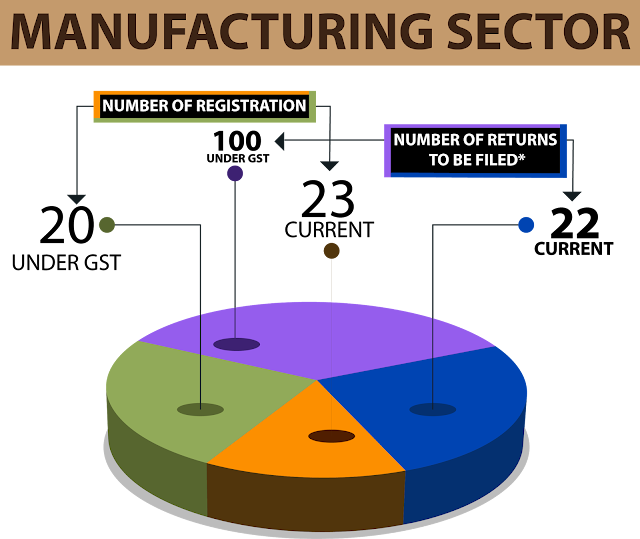

A manufacturer having two factories and having operations in

20 states would approximately have 23 registrations at present (one service tax,

20 value added tax, VAT and two excise). Under the GST the registration’s

number would reduce to 20. (1 for each of the state). On the other hand ,there

would be an increase in the number of returns from 22(20 VAT returns and 2

Excise returns) to 100 (four to five returns per registration) per month.

GST

- Are the companies prepared?

Though the monthly returns under GST would comprise of the statement

of procurement and statement of supplies yet they would not only have to be

prepared but also filed separately on the date specified.

As per the present law, the purchase-sale reconciliation is

a requisite only for credits under the law of the VAT of only Audit Outsourcing certain states.

Such reconciliation isn’t required for the Service and excise tax laws. However,

after the implementation of the GST, the procurement of the taxpayers would

have to be reconciled with the vendors’ sales and goods. Services’ supply would

also have to be reconciled with the purchasers every month; for avoiding

imposition of the liability of the tax and denial of tax credit of the input.

For each state, GST of three different types (state GST,

central GST and integrated GST) would have to be maintained as separate credit

pools. The requirement for these three separate credit pools is because of the

availability of the GST paid on procurement as credit against Ind AS Implementation GST liability of

the output. A company possessing operations in 20 different states would have

to be having 60 credit pools as compared to the 23 credit pools. The Company

would also require 60 output tax accounts instead of 23 output tax accounts.

The increased compliances would enhance the transparency and

the result would be positive on the Indian economy. The industry need to set in

place the appropriate ERP systems and the appropriate processes for handling

the change the GST would bring.

No comments:

Post a Comment